The debt-to-income (DTL) ratio is a standard yardstick that many lenders use to determine the soundness of the mortgage applications that come across their desks. In fact, one of the most common reasons for denying a loan is because the potential borrower has monthly payments that exceed the standard limit of 43 percent. Possible reform that could go into effect in 2021 could ease these standards and make it easier for some to qualify for a mortgage.

How DTL Ratios Work

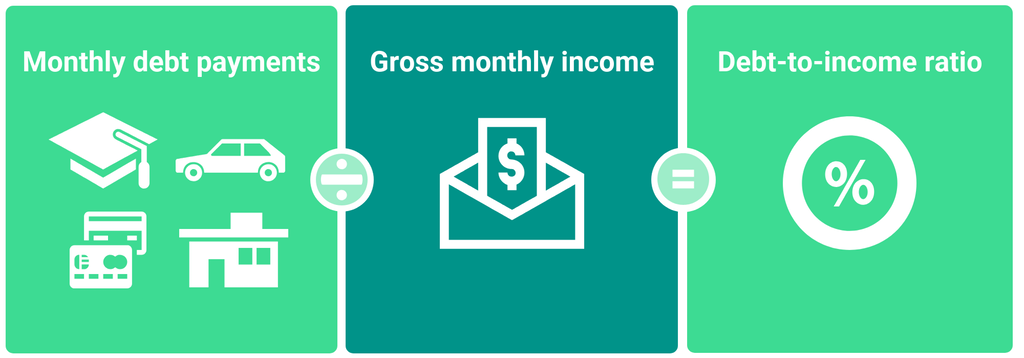

While lenders look at a number of factors when scrutinizing an application for a mortgage, the DTL ratio is one of the most important. It’s determined by comparing the borrower’s gross monthly income with their recurring monthly debts.

Broken down further, DTL looks at the income before taxes are taken out. A borrower can also count nontaxable payments such as child support and alimony as income.

This is compared to debt such as auto loans, credit card payments and student loans. Once these monthly payments are added up, that figure is combined with the borrower’s monthly housing costs.

DTI Requirements

It’s important to note that loan programs often have different DTI requirements. Both FHA and USDA loans, as well as conventional loans that are backed by Fannie Mae or Freddie Mac, traditionally have DTI ratios of 43 percent. VA loans typically require a DTI of 41 percent.

Many loan programs have exceptions and/or adjustments that allow them to approve mortgage applications from borrowers with higher DTI ratios than those noted above. Lenders often underwrite conventional loans from borrowers with higher DTI ratios than 43 percent.

The GSE Patch

The GSE patch — GSE is an acronym for government sponsored enterprise — applies to conventional loans. It allows the DTI ratios for such loans to drop below the traditional 43 percent. As a result, more than three million borrowers have qualified for mortgages over the past five years. Many of them might not have been able to qualify without the GSE patch in place. It’s scheduled to expire in January 2021.

The argument against keeping the GSE patch centers around DTI ratios. These are often measured incorrectly which means some applicants are being denied access to a mortgage when they shouldn’t be. While conventional thinking has been that a higher DTI ratio equals a riskier mortgage, this isn’t always true. Additional income sources, larger down payments and/or good credit could offset a high DTI ratio.

There is also an argument that points out that using DTI ratios isn’t a great measurement when it comes to a borrower’s ability to pay off their mortgage. Using loan-to-value (LTV) ratios, FICO and credit scores are usually better at predicting this.

Getting rid of DTI requirements altogether could make it easier for borrowers to qualify for a mortgage. Buyers who have a DTI ratio of more than 43 percent would have access to a slew of loan options including government-backed programs and those offered by private loan companies. These additional options would allow borrowers to compare different costs, rates and incentives so they can make the right choice and perhaps save across the lifetime of their mortgage.

Protected with 256 bit SSL

Protected with 256 bit SSL