The number of people applying for a mortgage has increased, leaving many economists excited about the future of real estate. What is driving this increase and how long will it last? Here’s what the latest data is showing.

Data from July 2017

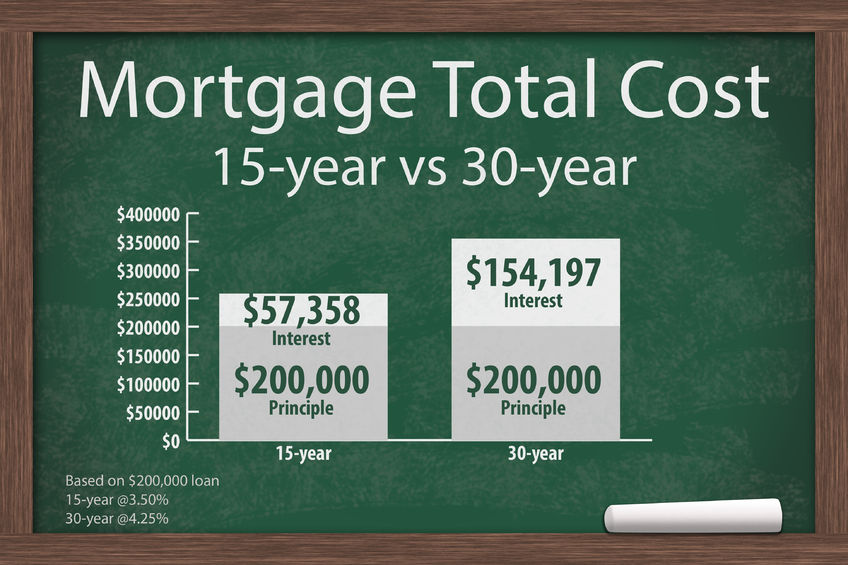

Figures from the first week of July 2017 show us that interest rates had their biggest five-day increase since just after the 2016 presidential election. During that week, the average interest rate for a 30-year, fixed-rate mortgage of $424,100 or less was 4.20%. This figure was up from the previous 4.13%, and was the highest interest rate in a two-month period. At the same time, points (including the origination fee) dropped from 0.32 to 0.31.

Protected with 256 bit SSL

Protected with 256 bit SSL